General Electric Q2 preview: Macro clouds loom over Q2 performance (NYSE:GE)

jetcityimage/iStock Editorial via Getty Images

General Electric (NYSE:GE) is scheduled to announce Q2 earnings results on Tuesday, July 26th, before market open.

About a week prior to its Q2 earnings release, the company unveiled brand names of its three new business units ahead of its planned separation into three public companies. As part of this ambitious restructuring effort, it will spin off its healthcare business first in 2023, followed by its energy businesses in early 2024.

Ahead of the Q2 report, Morgan Stanley suggested a turnaround is unlikely following the earnings, and advised clients to “avoid shares in front of Q2 earnings as H2 expectations need to come down.”

Similarly, JP Morgan told it was “too early to step in” on the stock ahead of its earnings release.

Most recently, Credit Suisse weighed in with a cautious call as well, citing “increased uncertainty around end market recovery in renewables, healthcare and commercial aerospace during 2022 based on geopolitical conflict, COVID in China and supply chain.”

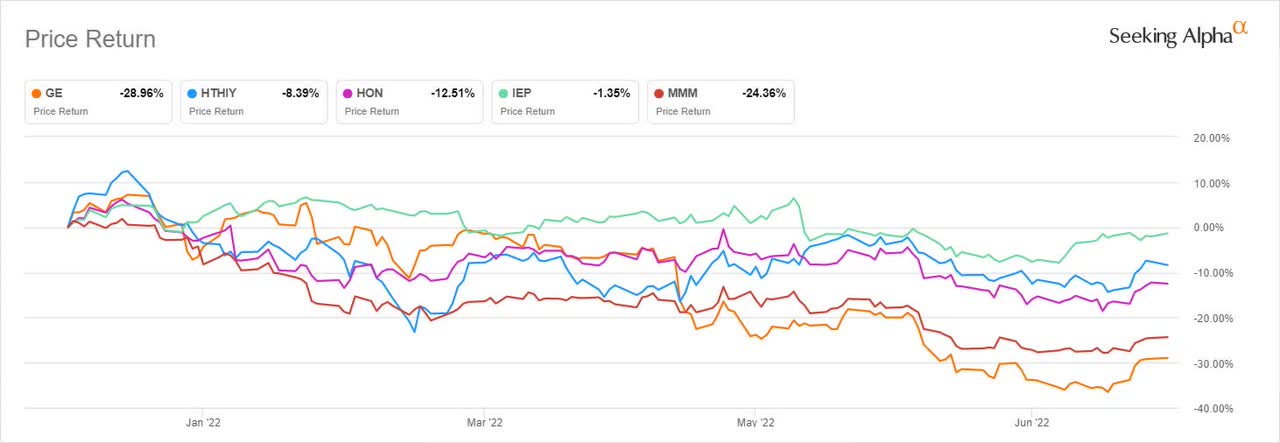

Shares have declined about 30% YTD, continuing a volatile trading pattern observable since Larry Culp’s accession to the CEO role in October 2018 despite efforts to streamline the business. Here is a look at GE’s price return performance YTD versus peers:

In April, shares tumbled to its lowest close since Nov. 2020 in GE’s biggest selloff in two years, after Culp said it was trending toward the low end of its 2022 financial forecast amid supply chain snarls and rising raw material costs.

Although Q1 adjusted earnings topped Wall Street estimates, the company said it sees full-year earnings at the low of its previous forecast of $2.80-$3.50/share.

The consensus EPS Estimate is $0.42 (+740.0% Y/Y) and the consensus Revenue Estimate is $17.9B (-2.2% Y/Y).

Over the last 2 years, GE has beaten EPS estimates 75% of the time and has beaten revenue estimates 50% of the time.

Over the last 3 months, EPS estimates have seen 0 upward revisions and 14 downward. Revenue estimates have seen 0 upward revisions and 11 downward.

SA contributor Daniel Jones recommended investors keep a keen eye on key indicators, including the aviation business performance, backlog, debt and cash flows.